Greek Debt Crisis

Greece joined the Eurozone in 2001 and was country among the first nations to join in the bloc after signing the Maastricht Treaty (The Treaty of European Union). Before joining the EU , the greek government followed an expansionary fiscal and monetary policy but these backfired as the country suffered high inflation , fiscal and trade deficits along with low growth rates and other exchange rates crisis.

In such a dismal economic environment , joining EU seemed a favourable step. This idea was believed on the idea that European Monetary Bank would intervene to help decrease the growing inflation rate and help in decreasing the nominal interest rates. This would then encourage private investments and help brining the economy back on track. Also , accepting a uniform currency throughout the EU would reduce the transaction cost and help reduce the budget and trade deficits that Greece incurred.

According to the Maastricht Treaty , the countries which joined EU needed less than 3% GDP as deficits and public debt of 60%. To join the EU , Greece had to undergo the most structural changes. In a desperate attempt to join the EU , the Greek Govt. doctored its deficits and debts to which they openly admitted to in 2004 , 3 years after joining the EU. The idea behind this was that joining the EU would help the impending economic crisis in Greece.

Causes

- Inefficient Pension system

According to Eurostat data , greek government spent almost 17.5% of its GDP to pay pension to the people. Greece’s struggle to pay pensioners is even more evident this week with banks closed and Greeks unable to withdraw more than 60 euros from ATMs.

2. Benefits

Greek government employees have best worker benefits. For example, an unmarried daughter used to receive her dead father’s pension though that specific practice stopped after the bailout agreement was made in 2010. A few laborers got atypical rewards for appearing at work on schedule, however these rewards were paid so specialists were not paid higher pensionable compensation. In any case, it’s a training that gravity measures dispensed with. Example : salaries for workers in the public sector rose every year, rather than based on factors like performance and productivity.

3. Early Retirement

The retirement age in greece was increased by 2 years , from 65 to 67 years. However the average age of retirement of men was 63 and women was 59. This case changed when it came to military or police officers who retired at ages between 40-45 years. There were some special cases also , for eg. women working in state banks who had children under the age of 18 could retire early. These created issues as these people could have worked for more than 15-20 years for a reduced pension. Also , the young mothers take advantage of schemes like these and they give up almost 2 decades of work. Workers who took this scheme could also exploit this as they would get extra money in the form of pension for december , considering its holiday month.

The above graph shows pension money given as a % of GDP

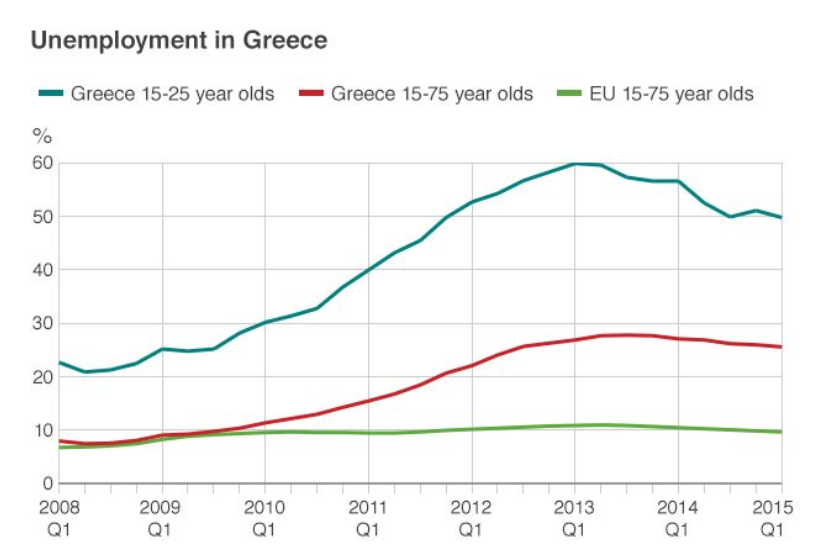

4. High Unemployment and Work Culture Issues

The unemployment rate is 25.6 percent in Greece. There is a lack of entrepreneurialism in Greece. A person would show up to work early and leave early and they would have no issues. The mindset of the people says that “if I don’t get paid how will i pay it to you.” and this issue is also highlighted in their work ethic and culture. This is not the right foundation that an economy should work on.

5. Tax Evasion

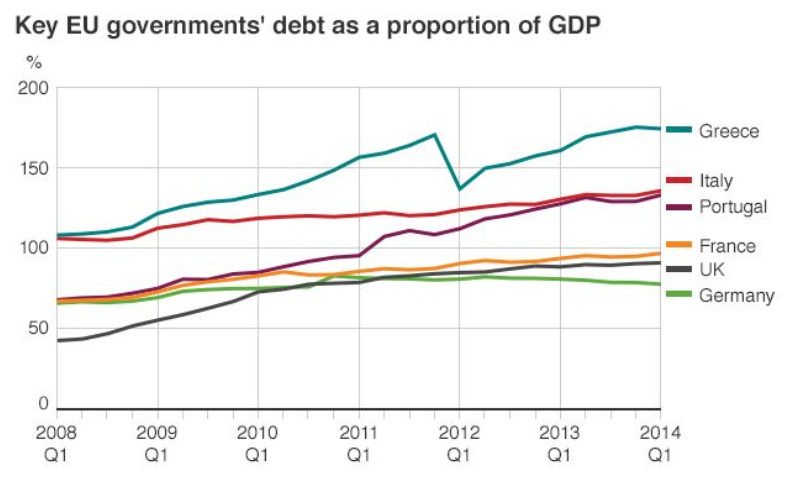

The government of the country is unable to collect taxes from its citizens , especially the rich and wealthy category of the society. The debt of the nation is 177% its GDP and a more efficient system has to be worked out to collect taxes from the rich and wealthy sections of the society , which the government says it has targeted.

Steps taken to improve by greek government –

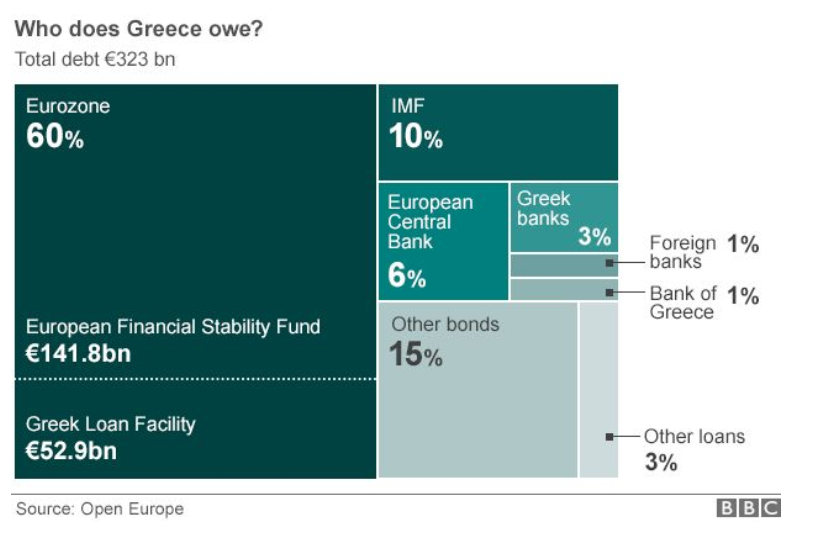

- Requested financial aid from European Union and IMF

One of the reasons for Greece to join Eurozone Nations was that it will get financial aid from the european union bank. Also , having the same currency throughout a bloc of nations was aimed at bringing down the trading cost and help improve the economy. Also they would get aid from European union bank which would help control their growing inflation.

2. Bailouts

These are essentially emergency loans which can be used to save the sinking economies. These were introduced in 2010 and were used by the greek government to help them.

3. Austerity Packages

Greek govt. Did receive some help from EU Bank and IMF but these came with their own terms and conditions which included policy reforms , tax reforms, etc.

Steps that the government could have taken –

- The government could have reinstated drachma as their currency which could have helped them hire new workers. This would have helped reduce the unemployment rate , boosted economic growth. By converting their euro based debt to drachma , the government could have printed more money and lowered its exchange rates. This would have encouraged foriegn tourists and help boost the economy bit by bit.

- An across the board Greek default would have a progressively prompt impact. To start with, Greek banks would have failed without advances from the European Central Bank. Loses would have undermined the dissolvability of other European banks, especially in Germany and France. They, alongside other private financial specialists, held 34.1 billion euros in Greek obligation. If Greece had defaulted, the ECB would have been fine. It was impossible that other obliged nations would have defaulted.

Therefore, a Greek default wouldn’t have been worse than the 1998 Long-Term Capital Management obligation emergency. The IMF avoided numerous defaults by giving capital until their economies had improved. The IMF claims 21.1 billion euros of Greek obligation, insufficient to exhaust it.

The Future –

The greek government before taking any decision took a vote from the general public.

Millions of Greeks were given the chance to have their say on whether to accept the terms of the latest international bailout.

A country-wide referendum held on 5 July asked voters if they supported the austerity demands of its creditors, which included raising taxes and slashing welfare spending.

The governing radical-left Syriza party had urged people to vote “No” – arguing the terms were humiliating – while the “Yes” campaign warned that a “No” result could see Greece ejected from the eurozone.

In the end, voters decisively rejected the bailout terms, with 61.3% voting “No” and 38.7% voting “Yes”.

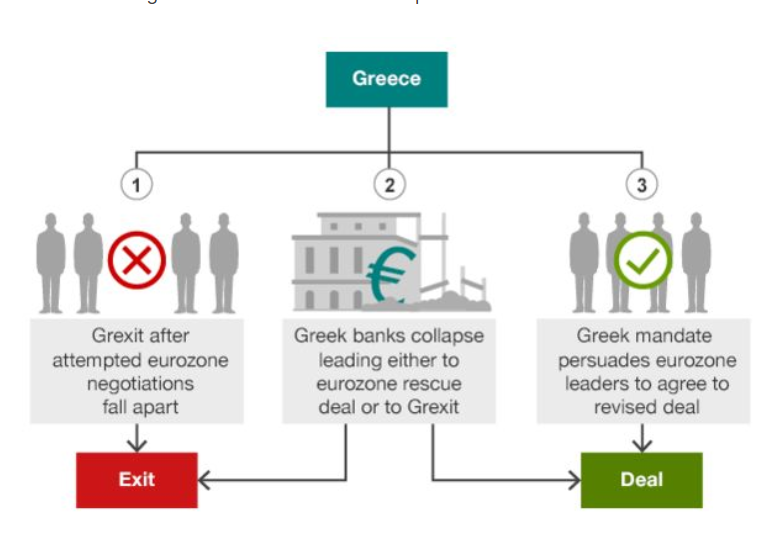

Experts suggest there are at least three scenarios after the country’s “No” vote:

- A failed deal that leads to Greek exit of the eurozone

- A Greek bank collapse leads to Greek exit… or a deal

- EU leaders agree deal and avert bank collapse

If a new currency is introduced it has to be made sure that it is not leaked to the outside world.

Conclusion

Regardless of gravity measures, numerous parts of Greece’s economy are as yet hazardous. Government spending makes up 48 percent of the GDP while EU bailouts contribute around 3 percent. Starting in 2017, Greece depends on the travel industry for 20 percent of GDP. Administration regularly defers business ventures for a considerable length of time. The legislature has contracted, yet it is as yet wasteful. There is an excessive amount of political support. Government basic leadership is brought together, further moderating reaction time.

This administration, joined with misty property rights and legal snags, has shielded Greece from selling 50 billion euros worth of state-claimed resources. Just 6 billion euros worth of property has been sold since 2011.

Tax avoidance has gone underground as more individuals work operating at a profit economy. It presently includes 21.5 percent of GDP. Subsequently, less individuals are covering higher regulatory obligations to get less from the administration than they did before the emergency.

A significant number of the employments accessible are low maintenance and pay not exactly before the emergency. Accordingly, a huge number of the best and most splendid have left the nation. Banks haven’t totally recovered, and are reluctant to make new credits to organizations. It will be a moderate street to recuperation.